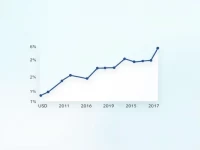

US Dollar Fluctuates Sharply Against Sri Lankan Rupee

This article analyzes the exchange rate fluctuations between the US dollar and the Sri Lankan rupee (USD/LKR). Current data shows that 1 US dollar is equivalent to 300.715 rupees, with significant volatility over the past year, reflecting the challenges in Sri Lanka's economy and changes in investor confidence. Understanding this dynamic is crucial for seizing market opportunities.